Clinical Laboratory Instruments Market to Reach US$ 91.61 Billion by 2033 at 7.4% CAGR | DataM Intelligence

Global clinical laboratory instruments market to hit US$ 91.61B by 2033, fueled by automation, molecular diagnostics, and rising disease burden.

Automation and molecular innovation are transforming clinical labs, enabling faster, more accurate diagnostics worldwide.”

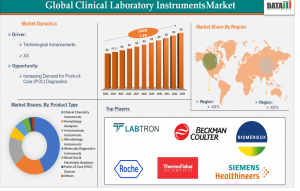

LOS ANGELES, CA, UNITED STATES, November 14, 2025 /EINPresswire.com/ -- Global Clinical Laboratory Instruments Market reached US$ 48.55 billion in 2024 and is expected to reach US$ 91.61 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.— DataM Intelligence

Get a Free Sample Research PDF: https://datamintelligence.com/download-sample/clinical-laboratory-instruments-market

Industry Latest News 2025:

✅ 10 Mar 2025 — USA: Beckman Coulter received FDA 510(k) clearance for the new DxC 500i integrated clinical chemistry + immunoassay analyzer (product launch / clearance).

✅ 16 Apr 2025 — USA: Abbott announced a major U.S. manufacturing and R&D investment (~$500M) to expand its transfusion/diagnostics capacity (manufacturing / capacity expansion impacting instrument supply).

✅ 15 Apr 2025 — USA / Global (company HQ Netherlands): QIAGEN announced plans to launch three new automated sample-preparation instruments during 2025–2026 (product launches / lab automation).

✅ 02 Sep 2025 — Japan: Sysmex resolved to acquire JEOL’s medical/clinical equipment business (share transfer agreement / M&A to expand clinical chemistry portfolio).

✅ 26 Mar 2025 — Korea (deal announced / press): DKSH signed agreement to acquire Molecular Diagnostics Korea Inc. (MDxK) — expansion of molecular diagnostics distribution/services in South Korea (M&A).

✅ 04 Jul 2025 — Korea: Seegene unveiled/launched STAgora™ (and related platforms) for infectious-disease analytics / unattended PCR automation at ADLM 2025 (product launch / platform announcement).

✅ 28 Jul 2025 — Korea: OSR Holdings signed terms to acquire Woori IO, a Korean non-invasive glucose-monitoring developer (M&A affecting diagnostics device landscape).

✅ 31 Mar 2025 — Europe (Spain): Eurofins Scientific completed its acquisition of SYNLAB’s clinical diagnostics operations in Spain (M&A; assets include genetics, anatomical pathology and clinical testing operations).

Market Geographical Share:

North America accounts for a significant share of the global market, driven by advanced healthcare infrastructure, high test volumes, and rapid adoption of automated analyzers and molecular diagnostic systems. Strong investment in hospital laboratories and the presence of major instrument manufacturers further strengthen regional dominance.

Asia-Pacific is the fastest-growing region, supported by expanding healthcare expenditure, rising incidence of chronic and infectious diseases, and rapid establishment of new clinical laboratories. China, India, and Southeast Asia are seeing strong adoption of automated laboratory systems due to urbanization, rising patient volumes, and improving diagnostic awareness.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/clinical-laboratory-instruments-market

Market Drivers:

✅ Rising Incidence of Chronic and Infectious Diseases

Growing prevalence of diabetes, cancer, cardiovascular disorders, and infectious diseases is increasing the demand for diagnostic tests, driving greater adoption of advanced laboratory instruments.

✅ Technological Advancements and Automation

Automation in clinical labs—such as fully automated analyzers, integrated workflow systems, AI-driven diagnostics, and robotic liquid handling—enhances accuracy, reduces turnaround time, and boosts instrument uptake.

✅ Growing Need for High-Throughput Testing

Increasing patient volumes and the need for rapid testing in hospitals, diagnostic centers, and emergency care settings are pushing laboratories to adopt high-throughput chemistry, immunoassay, microbiology, and hematology systems.

✅ Expansion of Hospital and Diagnostic Laboratory Networks

Rapid growth of multi-center diagnostic chains, private laboratories, and hospital expansions, especially in emerging economies, is generating strong demand for new and replacement instruments.

✅ Rising Focus on Early Disease Detection and Preventive Healthcare

Greater awareness of preventive screening programs for cancer, metabolic diseases, and infectious conditions is driving continuous demand for clinical laboratory testing equipment.

✅ Adoption of Molecular Diagnostics and Point-of-Care Technologies

Integration of PCR instruments, nucleic acid extraction systems, and rapid molecular analyzers is contributing to market growth as genomics and precision diagnostics expand.

Segments Covered in the Clinical Laboratory Instruments Market:

By Type - Automated, Semi-automated, Manual

By Product Type - Clinical Chemistry Instruments, Hematology Analyzers, Immunoassay Instruments, Microbiology Instruments, Molecular Diagnostics Instruments, Blood Gas & Electrolyte Analyzers, Point-of-Care (POC) Devices, Others

By End-User - Hospitals, Diagnostic Laboratories, Academic & Research Institutes, Clinics & Ambulatory Surgical Centers

Regional Analysis for Clinical Laboratory Instruments Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Buy Now & Get 30% OFF — Grab 50% OFF on 2+ reports: https://www.datamintelligence.com/buy-now-page?report=clinical-laboratory-instruments-market

Major Key Players: Danaher Corporation, Thermo Fisher Scientific Inc., Siemens Healthineers AG, bioMerieux, Abbott, F. Hoffmann-La Roche Ltd., HORIBA Group, Bio-Rad Laboratories, Inc., BD, and Agilent Technologies, Inc.

✅ Danaher Corporation — A top-tier diagnostics leader (Beckman Coulter, Cepheid, Leica, etc.) with a large Diagnostics segment that generated roughly ~$9.7–9.8 billion in 2024, making Danaher one of the largest suppliers of clinical-lab instruments and automation worldwide.

✅ Thermo Fisher Scientific, Inc. — A massive life-sciences & instrumentation group (2024 revenue ≈ $42.9 billion) whose specialty diagnostics/business-unit scale makes it an important clinical-lab instruments supplier, though it has been restructuring/selling parts of its diagnostics portfolio (~$1.4B of specific diagnostics sales called out in reports).

✅ Siemens Healthineers AG — A leading global med-tech player with a strong laboratory diagnostics division and overall FY scale in the tens of billions (Lab + imaging businesses contributed to ~€20+ billion level operations), positioning Healthineers as a top supplier of clinical chemistry, immunoassay and automation systems.

✅ bioMérieux — A focused specialist in clinical microbiology and infectious-disease diagnostics with ~€3.98 billion in 2024 sales, holding strong market share in automated microbiology platforms (VITEK, BACT/ALERT, BIOFIRE) used in clinical laboratories worldwide.

✅ Abbott — A major diversified healthcare company with a large Diagnostics division (total company sales ≈ $42.0 billion in 2024 and diagnostics revenue in the roughly $9–10 billion range), active across core-lab, molecular and point-of-care instruments and a meaningful share of the clinical-lab instruments market.

Unlimited Insights. One Subscription: https://www.datamintelligence.com/reports-subscription

Related Reports:

Clinical Laboratory Incubators Market 2025

Clinical Laboratory Services Market 2025

Kailas Disale

DataM Intelligence 4market Research LLP

+1 877-441-4866

kailas@datamintelligence.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.