Packaged Red Meat Market Size to Surpass USD 1 Trillion by 2034, Driven by Convenience Trends and Advanced Packaging Technologies

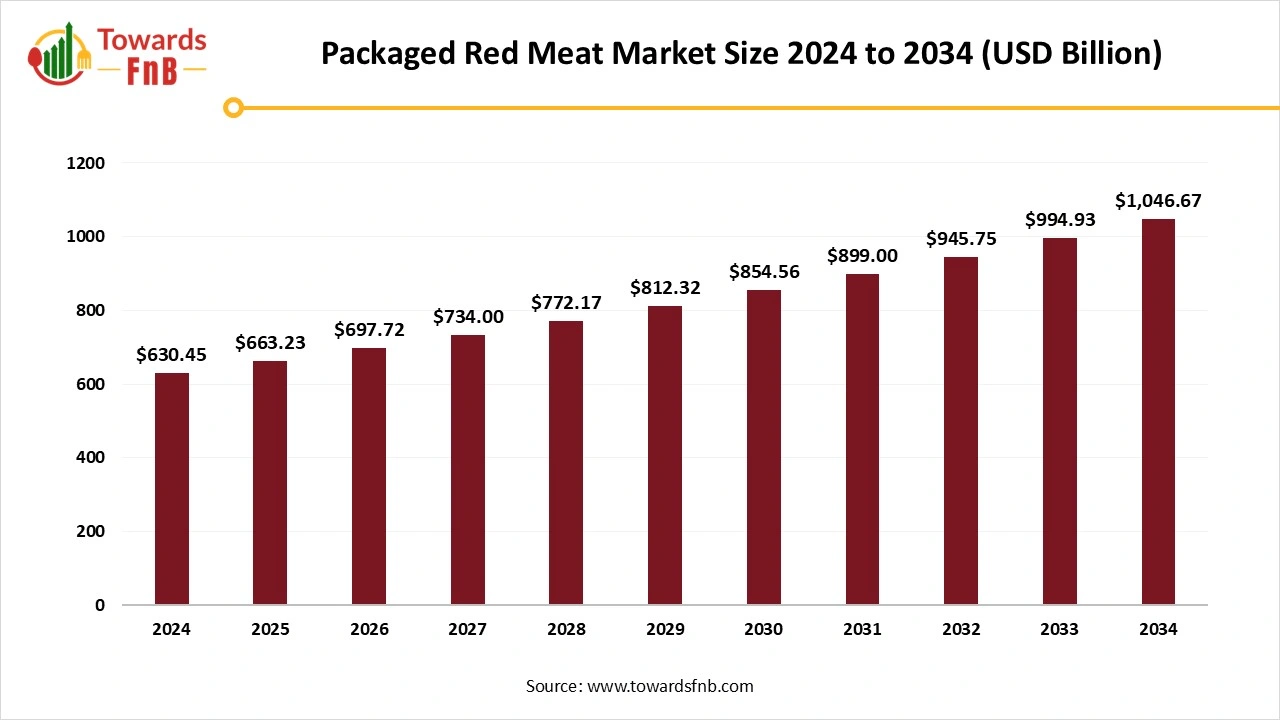

According to Towards FnB, the global packaged red meat market size is calculated at USD 663.23 billion in 2025 and is anticipated to surge USD 1,046.67 billion by 2034, advancing at a CAGR of 5.2% from 2025 to 2034. This steady expansion reflects the sector’s increasing reliance on improved processing capabilities, advanced packaging formats, and a widening distribution footprint across both traditional retail and online platforms.

Ottawa, Nov. 24, 2025 (GLOBE NEWSWIRE) -- The global packaged red meat market size stood at USD 630.45 billion in 2024 and is predicted to increase from USD 663.23 billion in 2025 to reach around USD 1,046.67 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow rapidly in the coming years due to high demand for protein-dense and convenient, ready-to-cook options from consumers with hectic lifestyles and limited time.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5924

Key Highlights of the Packaged Red Meat Market

- By region, North America led the packaged red meat market in 2025, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product type, the frozen red meat segment dominated the market with largest share in 2024, whereas the processed meat segment is expected to grow in the foreseeable period.

- By packaging format, the MAP segment led the packaged market in 2024, whereas the ready-meal trays and multi-pack formats segment is expected to grow in the foreseeable period.

- By end use, the supermarkets and hypermarkets segment captured the maximum share in 2024, whereas the foodservice segment is expected to grow in the forecast period.

- By animal, the pork segment led the market with highest share in 2024, whereas the beef segment is expected to grow in the expected timeframe.

The packaged red meat sector is evolving far beyond traditional retail formats,” said Vidyesh Swar, Principal Consultant at Towards FnB. “Advanced packaging technologies, AI-driven processing efficiencies, and shifting global trade flows are collectively reshaping how red meat is produced, packaged, and consumed.”

As demand rises in Asia Pacific and premiumization spreads across Europe and North America, companies that invest in automation, sustainability, and cold-chain modernization will lead the next decade of growth.

Higher Demand for Convenience is Helpful for the Growth of the Packaged Red Meat Industry

The packaged red meat market is observed to grow due to higher preference for convenience, protein-rich options, and advanced packaging technology. The market offers a variety of meat options, including pork, beef, lamb, and other red meat cuts, which are highly demanded globally. These are available in different types of technologically advanced packaging options, such as MAP, chilled trays, vacuum sealing, and various other options. These cuts are available to consumers across different platforms, including offline and online, allowing them to buy the right option with ease and helping fuel the market's growth.

Advanced Packaging is helpful for the Growth of the Packaged Red Meat Market

- Modified Atmosphere Packaging (MAP) - The form of packaging helps control gases and prevent bacterial growth, thereby enhancing the shelf life of packaged red meat and ensuring its quality.

- High-Barrier Films - They help prevent moisture and oxygen from contacting the packaged red meat, enhancing its shelf life.

-

High-Pressure Processing- The procedure helps to inactivate pathogens and enzymes, to maintain the quality of the packaged product, which is helpful for the market’s growth.

Recent Developments in the Packaged Red Meat Market

- In November 2025, Beyond Meat, a vegan food product brand, expanded its offerings in Canada, with the launch of a new value pack for its Beyond Beef Product. The new pack contains twice as much product as the single pack.

- In April 2025, the US Meat Export Federation partnered with the USDA’s Foreign Agricultural Service and a Peruvian importer to introduce two US red meat products. A liver burger and liver meatballs were developed with the US beef liver and US ham, which are affordable and high in protein.

New Trends in the Packaged Red Meat Market

- Technological advancements to extend the shelf life of packaged red meat, while maintaining its taste and texture, are a major factor driving market growth.

- Higher demand for premium, grass-fed, organic, and sustainable meat options is another major factor fueling the market’s growth.

- Growth of online platforms and subscription models is another major factor in engaging consumers and enhancing the growth of the market.

Impact of AI in the Packaged Red Meat Market

Artificial intelligence is transforming the packaged red meat market by improving processing efficiency, quality control, and supply chain reliability. In production facilities, AI-powered computer vision systems inspect meat cuts for texture, marbling, color, and surface defects with far greater precision than manual inspection. These systems also quickly detect contamination risks and foreign objects, helping companies maintain strict safety standards and reduce product recalls. Machine learning models optimize slicing, trimming, and portioning equipment, allowing processors to achieve consistent weight and cut accuracy while lowering waste and labor costs.

AI also plays an important role in cold chain management. Sensors and predictive analytics monitor temperature, humidity, and storage conditions throughout transport and warehousing. This allows producers and retailers to prevent spoilage, extend shelf life, and maintain regulatory compliance. In packaging lines, AI supports automation that improves sealing accuracy, reduces material consumption, and enhances labeling integrity.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/packaged-red-meat-market

Trade Analysis of the Packaged Red Meat Market

Import & Export Statistics

Global trade in meat and meat products was about 40–42 million tonnes (carcass weight equivalent) in 2023, representing roughly 10-11% of global meat output. Trade volumes declined slightly in 2023 from the 2022 peak and showed early signs of regional recovery in 2024 as supply constraints eased.

Leading Exporters by Species and Representative Magnitudes

-

Beef. The United States, Australia and Canada are among the largest exporters of fresh and chilled beef. For example, exports of fresh or chilled boneless bovine meat were about USD 4.11 billion for the United States and USD 2.74 billion for Australia in 2023. These figures reflect large, high-value chilled and boxed-beef shipments to premium markets.

-

Pork. Major pork exporters include the European Union, the United States and Brazil for selected product lines, with strong shipments into East Asian markets. USDA and customs records show notable US and EU pork exports in 2023–2024.

-

South America role. Brazil remains a dominant global supplier across beef and poultry and recorded record processing and export volumes in 2023, exporting over 2.0 million tonnes of fresh beef that year. Brazil’s scale materially shapes global red meat trade flows.

Major Importers and Demand Hubs

- China has been a major driver of recent import growth for beef and other red meats, with import spending rising sharply since 2019 and peaking in 2023. China’s import expansion reshaped trade flows, increasing demand for shipments from Brazil, Argentina and Australia. Recent policy actions have also targeted import surges.

- Other large import markets include the United States, Japan, South Korea and the European Union, where demand is driven by a combination of domestic consumption patterns, processing needs and retail preferences for packaged and processed red meat products.

Product forms, logistics, and pricing signals

Trade covers chilled boxed beef, frozen whole carcases, primals and subprimal cuts, value-added processed cuts and prepared products. Chilled boxed beef commands premium unit values and requires rapid cold-chain logistics, while frozen product shipments enable longer-distance trade at lower unit cost. Tariff classification, sanitary certificates and cold-chain integrity are therefore central to landed cost and partner choice.

Packaged Red Meat Market Dynamics

What are the Growth Drivers of the Packaged Red Meat Market?

The market is expected to grow due to higher demand for convenient, packaged, protein-rich options, allowing consumers to access nutritious foods while saving time. Such options help consumers avoid unhealthy food choices and stay on track with their health goals. Packaged red meat is convenient to use, maintains its nutritional properties, and has a longer shelf life due to improved cold chain infrastructure, helping keep the meat from rotting.

Challenge

Environmental and Ethical Issues hampering the Market’s Growth

Issues such as greenhouse gas emissions, deforestation, and water consumption hamper market growth. Various other issues, such as scrutiny by environmentalists, the government, and environmentally conscious consumers, are another restriction observed in the growth of the packaged red meat market. Concerns such as animal welfare are another major factor restraining market growth.

Opportunity

Growing Demand for Convenient Options Is Helpful for the Industry’s Growth

The hectic lifestyles of consumers these days lead to a higher demand for convenient, nutritious food options. Such food options are rich in nutrients and have a stable shelf life, which is further helpful for market growth. Pre-cooked sausages, deli meat options, and similar products are expected to drive market growth in the foreseeable future. Such options are healthier and can be consumed more quickly, providing an opportunity for market growth.

Product Survey of the Packaged Red Meat Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End Use Segments | Representative Producers / Brands |

| Packaged Fresh Beef Cuts | Chilled and vacuum-packed beef portions with minimal processing. | Steaks, roasts, ground beef, stew meat | Retail grocery, butchers, foodservice | Tyson Foods, JBS, Cargill, Australian Agricultural Company |

| Packaged Fresh Lamb and Mutton | Vacuum-packed or MAP-packed lamb products for retail sale. | Lamb chops, leg of lamb, minced lamb | Retail, premium stores, foodservice | Silver Fern Farms, Alliance Group, Minerva Foods |

| Packaged Fresh Pork Cuts | Ready-to-cook pork is sold in sealed packs for freshness and hygiene. | Pork loin, ribs, belly, minced pork | Retail, butchers, restaurant supply | Smithfield Foods, Hormel Foods, Tyson Foods |

| Marinated and Ready to Cook Red Meat | Pre-seasoned red meat is prepared for quick, convenient cooking. | Marinated beef strips, spiced lamb cubes, and pork marinades | Meal kits, retail convenience meals | BRF, CP Foods, Maple Leaf Foods |

| Frozen Red Meat Products | Fully frozen red meat ensures a long shelf life. | Frozen beef, frozen lamb, frozen pork cuts | Retail, export markets, and institutional buyers | JBS, Minerva Foods, Pilgrim’s Pride |

| Processed and Value Added Red Meat | Meat products are treated through curing, smoking, or controlled cooking. | Sausages, bacon, ham, deli slices | Retail deli, fast food, sandwiches | Hormel Foods, Conagra Brands, WH Group |

| Premium and Specialty Red Meat | High-grade, traceable, or gourmet cuts targeted at premium customers. | Wagyu beef, Angus beef, heritage pork, organic lamb | Gourmet retail, fine dining, premium supermarkets | Snake River Farms, Mishima Reserve, Cabassi, D’Artagnan |

| Organic and Antibiotic-Free Packaged Red Meat | Products are certified organic or sourced from antibiotic-free animals. | Organic beef, grass-fed beef, organic lamb | Health-conscious consumers, specialty retail | Applegate, Organic Valley, Perdue Farms |

| Halal and Kosher Certified Red Meat | Meat processed according to religious certification standards. | Halal beef and lamb, kosher beef cuts | Middle Eastern markets, Jewish markets, and global retail | Al Islami Foods, Midamar, Empire Kosher |

| Tray Ready and MAP Packed Red Meat | Modified atmosphere packaged (MAP) products for extended shelf life and bright color retention. | MAP beef cuts, pork MAP trays, lamb MAP trays | Modern retail, supermarkets, online grocery | Tyson Fresh Meats, Hilton Foods Group |

| Cooked and Ready to Eat Red Meat | Fully cooked red meat products require no preparation. | Cooked meat slices, roast beef, pulled pork | Convenience retail, meal kits, snacking | Conagra, Hormel, Maple Leaf Foods |

| Smoked and Cured Red Meat | Specialty meat produced using traditional and industrial curing. | Pastrami, corned beef, smoked pork | Deli foods, sandwiches, gourmet retail | Smithfield, JBS Prepared Foods, Boar’s Head |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5924

Packaged Red Meat Market Regional Analysis

North America Led the Packaged Red Meat Market in 2024

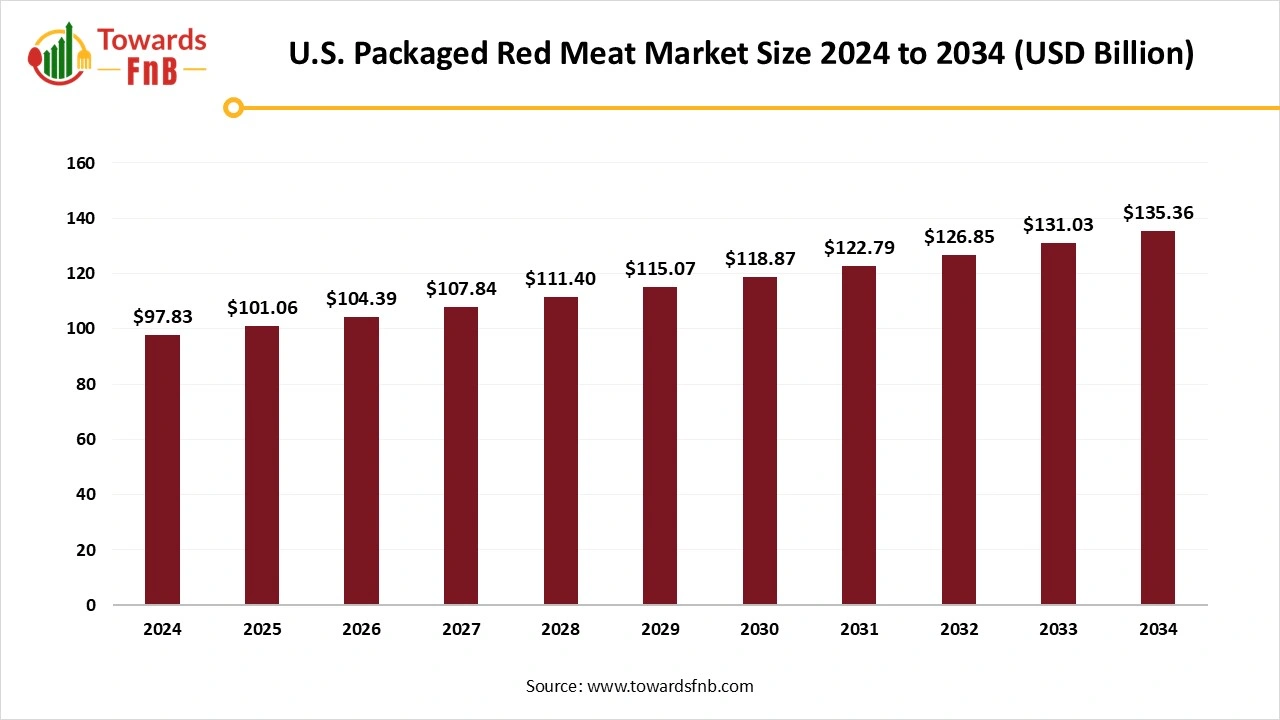

North America dominated the packaged red meat market in 2024 due to high demand for convenient, ready-to-eat, packaged, and high-protein meat options. Such factors helped fuel the market's growth in the region. The availability of red meat across different platforms in the region is another major factor driving market growth. Improving sustainability, packaging and shelf life, maintaining intact nutritional qualities, and higher demand for protein-dense options are other major factors driving market growth. Higher demand for frozen meat options also helps to fuel the market’s growth. The US has a major role in driving market growth in the region due to high demand for convenient, frozen, protein-rich meat options.

How will the U.S. Packaged Red Meat Market Grow from 2025 to 2034?

The U.S. packaged red meat market size was valued at USD 97.83 billion in 2024 and is projected to rise from USD 101.06 billion in 2025 to reach approximately USD 135.36 billion by 2034, expanding at a steady CAGR of 3.3% throughout the forecast period. The market’s growth is being reinforced by a noticeable slowdown in plant-based meat adoption, renewed consumer interest in traditional protein sources, and the rapid rise of personalized and custom-cut meat services.

Asia Pacific is Expected to Grow in the Foreseeable Period

Asia Pacific is expected to grow over the forecast period due to rapid urbanization, rising disposable incomes, and higher demand for convenient, ready-to-eat, and frozen meat options. Such meat options retain their nutritional qualities and have a stable shelf life, further helping the market grow. Improving cold chain infrastructure and processing technologies also helps fuel market growth. Countries such as India, China, Japan, and South Korea have made major contributions to the region's market growth due to higher demand for protein-rich, convenient, and sustainable food options, which are driving the market’s expansion.

Europe is Observed to Have a Notable Growth in the Foreseeable Period

Europe is expected to see notable growth over the forecast period due to higher demand for packaged red meat. It allows consumers to prepare nutritious meals more quickly while maintaining their hectic schedules. The market is also observed to be growing due to the availability of different types of meat in various forms, easily accessible on both offline and online platforms. Germany, the UK, and France are the key market regions due to higher demand for convenient, nutrient-rich options, which is driving growth in the packaged red meat market.

Packaged Red Meat Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.2% |

| Market Size in 2025 | USD 663.23 Billion |

| Market Size in 2026 | USD 697.72 Billion |

| Market Size by 2034 | USD 1,046.67 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Packaged Red Meat Market Segmental Analysis

Product Type Analysis

The frozen red meat segment dominated the packaged red meat market in 2024 due to its multiple benefits, such as convenience, ease of storage, maintenance of nutritional quality, and the ability to prepare unique dishes in less time. Hence, the segment has a large consumer base of people with hectic schedules and a time crunch. Frozen red meat maintains stable shelf life and retains intact vitamins, minerals, and other essential nutrients for the human body. Hence, such factors help boost market growth.

The processed, cured, or deli segment is expected to grow over the forecast period, as it is highly demanded by consumers with a busy lifestyle. Such ready-to-cook and ready-to-eat options help save time and allow one to prepare nutritious dishes more quickly. Such meat options retain their nutritional qualities and maintain a shelf life, which is helpful for market growth in the foreseeable period.

Packaging Format Analysis

The Modified Atmosphere Packaging (MAP) market dominated the packaged red meat market in 2024, as the process helps maintain the meat's taste, nutrition, and color. It also helps extend the shelf life of red meat, further fueling market growth. The method also slows the chemical reaction, enhancing the quality of red meat, which is helpful for market growth.

The ready-meal trays and multi-pack formats segment is expected to grow over the forecast period, mainly due to factors such as convenience, time-saving, high nutritional quality, maintained hygiene standards, and other benefits. The segment has a large consumer base of individuals with hectic lifestyles who are seeking protein-rich options that require less time. Such factors are expected to drive the growth of the packaged red meat market in the foreseeable future.

End-Use Analysis

The supermarkets or hypermarkets segment led the packaged red meat market in 2024 due to higher demand for an offline shopping experience, improved cold chain logistics and transport, and demand for fresh red meat. The segment also observes growth due to the availability of various other options and checks them in reality for a better shopping experience. Customization in cuts and quantity is another major factor for the market’s growth, supported by rising disposable income, quality protein-rich options, and higher demand for convenient options.

The food service segment is expected to grow in the foreseeable period due to higher demand for convenient, ready-to-cook, and ready-to-eat options to save time. The segment also has higher demand from consumers with tight schedules and in search of healthy, protein-dense options. The expansion of quick-service restaurants and various foodservice options is expected to fuel market growth in the foreseeable future.

Animal Analysis

The pork segment dominated the packaged red meat market in 2024 due to strong consumer demand globally, in both fresh and frozen forms. It is also highly demanded in different types such as salami, ham, and bacon. They are easily available at supermarkets, hypermarkets, online platforms, and retail stores. These factors together help fuel the market's growth.

The beef segment is expected to grow over the foreseeable period due to high demand in household and commercial kitchens. The market is also observed to be growing as beef is available on various platforms, including retail stores, online platforms, supermarkets, and hypermarkets. It allows consumers to easily shop for meat at discounted prices and browse various other meat options. Hence, these factors together help market growth in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Packaged Red Meat Market

- JBS S.A. – One of the world’s largest meat processors, supplying packaged beef, pork, and lamb across retail and foodservice sectors. JBS emphasizes global sourcing, large-scale production, and expanding value-added product lines.

- Tyson Foods, Inc. – A major U.S. producer of beef, pork, and prepared meats with a strong presence in packaged retail products. Tyson focuses on branded offerings, supply-chain efficiency, and integrated processing.

- Smithfield Foods (WH Group) – The world’s largest pork processor, offering packaged fresh pork, bacon, ham, and ready-to-cook products. Smithfield leverages global operations and strong brand recognition in North America and Europe.

- Cargill, Incorporated – A leading producer of packaged beef and value-added red meat products for retail, foodservice, and exports. Cargill invests heavily in automation, sustainability, and protein diversification.

- Marfrig Global Foods S.A. – A major beef exporter and producer of packaged chilled and frozen red meat products. Marfrig focuses on sustainability programs and premium beef categories.

- Hormel Foods Corporation – Provides branded packaged meats under names like Hormel, Applegate, and Columbus. The company specializes in ready-to-eat and value-added red meat offerings.

- BRF S.A. – A Brazilian multinational producing packaged meat products, including further-processed beef and pork items. BRF leverages strong brands and global export capability.

- Pilgrim’s Pride (JBS-owned) – Known primarily for poultry but also active in packaged beef and pork through JBS’s integrated network. Pilgrim’s supplies retailers with value-added and private-label packaged meats.

- NH Foods Ltd. / Nippon Ham Group – A major Japanese producer of packaged red meat, processed meats, and ready-to-cook products. NH Foods operates strong regional brands with a focus on quality and traceability.

- Minerva Foods S.A. – A leading Latin American beef exporter offering packaged chilled and frozen beef products. Minerva is known for its wide export footprint across the Middle East, Asia, and Europe.

- Danish Crown A/S – A large European processor supplying packaged pork and beef products for retail and foodservice. Danish Crown emphasizes animal welfare, sustainability, and specialty cured meats.

- Seaboard Corporation – Operates integrated pork operations and produces packaged red meat products under the Seaboard Foods brand. The company exports extensively to Asia and Latin America.

- Conagra Brands, Inc. – Offers packaged red meat through brands in frozen meals, ready-to-eat proteins, and foodservice categories. Conagra integrates red meat into several value-added product lines.

- Maple Leaf Foods Inc. – A major Canadian meat processor producing packaged pork, beef, and alternative value-added meat products. The company focuses on sustainability, animal welfare, and premium retail brands.

- Minimally Processed / Private Label Specialists (e.g., OSi Group, National Beef, Triumph Foods) – Supply private-label packaged red meat for retailers and foodservice chains. These companies focus on efficiency, customization, and large-volume production.

- Perdue Farms / Sanderson Farms / Wayne Farms – Primarily poultry producers but also active in certain packaged red meat categories through partnerships and integrated protein offerings.

- Teys Australia / Australian & New Zealand Exporters – Major suppliers of grass-fed and premium packaged beef for Asia, North America, and Europe. These exporters emphasize traceability and high-quality chilled beef.

- Marfrig / Minerva / Other Latin American Exporters – Supply competitively priced packaged red meat to global markets, especially the Middle East, China, and Europe. They support large-scale export operations and diverse cuts.

- Smaller Regional Champions & Retail Processors – Local and mid-sized processors supplying region-specific packaged beef, lamb, and pork. They cater to niche markets, local retailers, and regional consumer preferences.

- Value-Added and Niche Brands / Plant-Adjacent Competitors – Companies offering premium, organic, grass-fed, or functional packaged red meat products, often competing with hybrid or plant-forward options in the premium segment.

Segments Covered in the Report

By Product Type

- Fresh / Chilled packaged red meat

- Frozen red meat

- Processed / Cured / Deli (sausages, cold cuts, hams)

By Packaging Format

- Trays with skin-pack or film (retail fresh trays)

- Modified Atmosphere Packaging (MAP) / Vacuum packaging

- Frozen blocks / bags / IQF portions

- Flexible pouches & shelf-stable tubs (processed meats)

- Ready-meal trays & multi-pack formats

By End-Use/Channel

- Retail / Supermarkets & Hypermarkets

- Foodservice (restaurants, quick-service, institutional)

- Convenience stores / online grocery / e-commerce

By Animal/Species

- Beef

- Pork

- Lamb & mutton

- Game & other red meats

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5924

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.