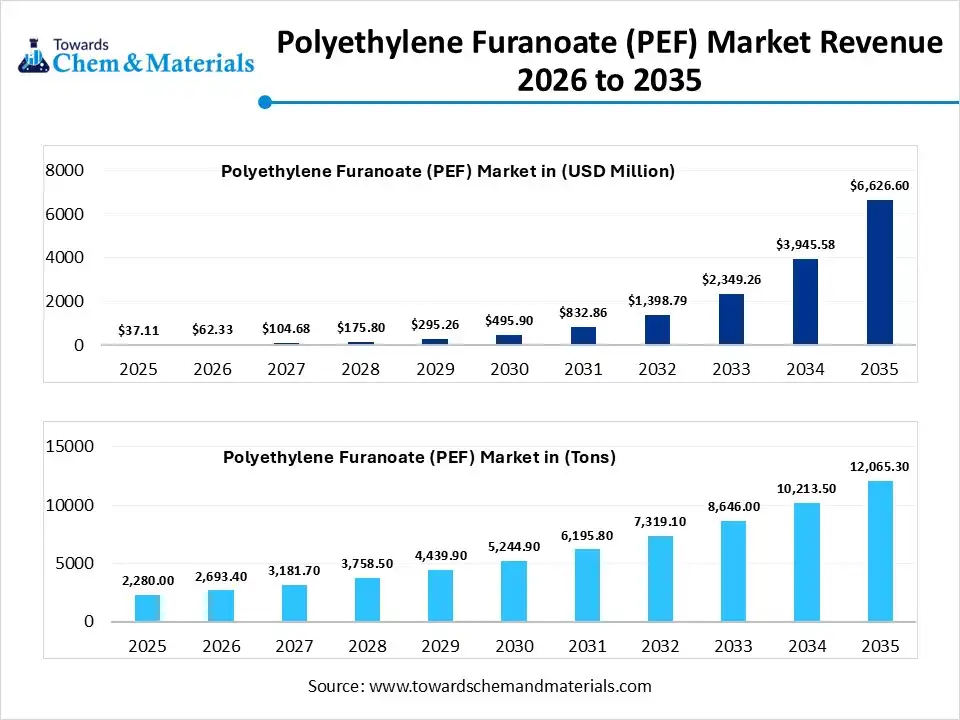

Polyethylene Furanoate (PEF) Market Volume Worth 12,065.3 Tons by 2035

According to Towards Chemical and Materials, the global polyethylene furanoate (PEF) market volume was valued at 2,280.0 tons in 2025 and is expected to be worth around 12,065.3 tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 18.13% over the forecast period from 2026 to 2035.

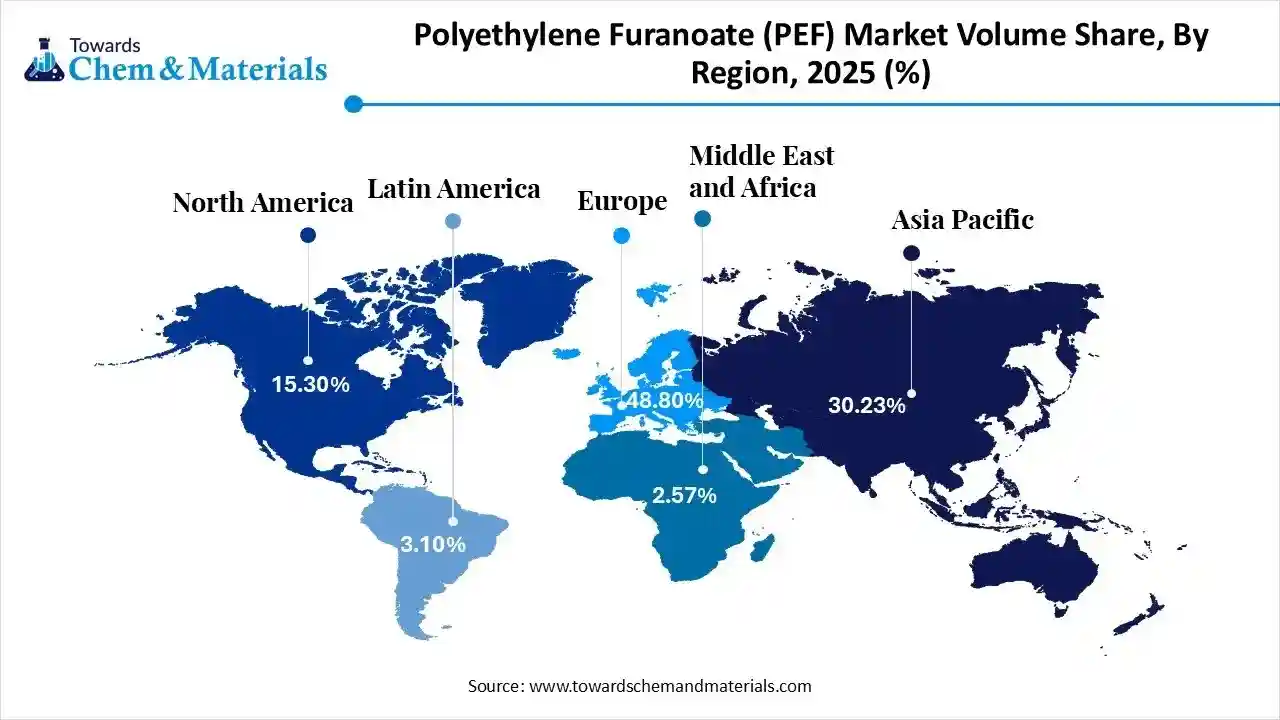

Ottawa, Jan. 29, 2026 (GLOBE NEWSWIRE) -- The global polyethylene furanoate (PEF) market size was estimated at USD 37.11 million in 2025 and is expected to increase from USD 62.33 million in 2026 to USD 6,626.60 million by 2035, growing at a CAGR of 67.95% from 2026 to 2035. In terms of volume, the market is projected to grow from 2,280.0 tons in 2025 to 12,065.3 tons by 2035. growing at a CAGR of 18.13% from 2026 to 2035. Europe dominated the polyethylene furanoate (PEF) market with the largest volume share of 48.80% in 2025. The heavy shift towards sustainable manufacturing has driven the industry's growth in recent years. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6148

PEF Unlocks New Potential Beyond PET

The plastic is made from the plant-based raw material called polyethylene furanaote. Moreover, providing better performance in many ways than regular PET plastics, the PEF has enabled the sector to explore untapped potential in recent years, as per the observation. Also, the major manufacturers of food packaging, bottles, and textiles are driving the industry growth in recent years.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Polyethylene Furanoate (PEF) Market Report Highlights

- The Europe dominated the global polyethylene furanoate (PEF) market with the largest volume share of 48.80% in 2025.

- The polyethylene furanoate (PEF) market in Asia Pacific is expected to grow at a substantial CAGR of 21.56% from 2026 to 2035.

- The North America polyethylene furanoate (PEF) market segment accounted for the major volume share of 15.30% in 2025.

- By grade, the standard grade segment dominated the market and accounted for the largest volume share of 54.80% in 2025.

- By grade, the high-performance grade segment is expected to grow at the fastest CAGR of 21.34% from 2026 to 2035 in terms of volume.

- By application, the bottles segment led the market with the largest revenue volume share of 67.4% in 2025.

- By end-use industry, the packaging segment dominated the market and accounted for the largest volume share of 59.1% in 2025.

- By source, the plant-based segment led the market with the largest revenue volume share of 42.4% in 2025.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6148

Polyethylene Furanoate (PEF) Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 62.33 Million / 2,693.4 Tons |

| Revenue Forecast in 2035 | USD 6,626.60 Million / 12,065.3 Tons |

| Growth Rate | CAGR 67.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Europe |

| Segment Covered | By Source, By Grade, By Application Area, By End-Use Industry, By Region |

| Key companies profiled | Avantium N.V., Sulzer Ltd., AVA Biochem AG, Origin Materials, TOYOBO CO., LTD., BASF SE, Mitsui & Co., Ltd., Corbion, Danone, ALPLA Group, Swicofil AG, Zhejiang Sugar Energy Technology Co., Ltd., Eastman Chemical Company, DuPont de Nemours, Inc., Toray Industries, Inc. , Gevo, Inc., Stora Enso, Sukano AG , ADM (Archer Daniels Midland), WIFAG-Polytype Holding AG |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments for Polyethylene Furanoate (PEF):

- Avantium: This Dutch chemical technology company is a pioneer in PEF commercialization and is building the world's first commercial-scale FDCA (a key PEF component) plant in the Netherlands.

- Origin Materials: Origin Materials is collaborating with Avantium to mass-produce FDCA and PEF products, leveraging their technology platforms to optimize production capabilities for sustainable materials.

- Toyobo Co., Ltd.: This Japanese company is actively involved in developing new PEF production processes and technologies, focusing on improving the material's properties and efficiency.

- ALPLA Group: A global packaging solutions provider, ALPLA has partnered with Avantium to explore and adopt PEF for bottles and other packaging applications, aligning with sustainability goals.

-

Carlsberg Group: As an end-user, Carlsberg is exploring the use of PEF bottles as a sustainable alternative to traditional glass or PET packaging, highlighting major brand investment in the material's application.

What Are the Major Trends in the Polyethylene Furanoate (PEF) Market?

- Integration with bottles and packaging: Ongoing testing of PEF in bottles and packages is driving the strategic transformation and sectoral scalability in recent years. Moreover, the major brands are testing how log drink stay fresh as per the recent survey.

- Promotion of sustainability: The greater promotion of eco-friendliness and sustainability has also positioned the industry for long term expansion in recent years.

-

Premium and high-quality products: the rapidly increasing demand for the high quality and premium products where quality and sustainability matter, the PEF has emerged as a catalyst that is expected to unlock sectors' full potential in the coming years.

Polyethylene Furanoate (PEF) Market Dynamics

Driver

Brands Shift Toward Greener PEF Solutions

The growing need for greener and cleaner packaging has resulted in high-yield outcomes for industrial players nowadays. The global governments are also playing a major role in the industry growth by applying significant rules and regulations with attractive benefits for the manufacturer which adopted manufacturing sustainability. Furthermore, several brands have observed replacing the regular plastic with PEF in the past few years.

Restraint

Limited Production Readiness Slows PEF Adoption

Limited large-scale production readiness is likely to hamper the industry's growth in the coming years. However, many companies want to use PEF but cannot get it in consistent volume. Production technology is still developing, which makes supply unstable. This creates hesitation among manufacturers who rely on continuous material availability.

Market Opportunity

What is the Most Significant Opportunity for the Polyethylene Furanoate (PEF) Industry?

Brand-driven sustainability demand is expected to create significant opportunities in the coming years. Global brands want materials that clearly show environmental responsibility. PEF offers a strong sustainability story without sacrificing performance. Companies can use PEF to differentiate products and meet future regulations early.

Scaling PEF Through Integrated Manufacturing

The industry has been moving from experimental production to integrated manufacturing systems in recent years. Earlier, PEF was produced mainly for testing and pilot projects. Now, technology is shifting toward stable, repeatable, and scalable production processes. Automation, improved catalysts, and better purification methods are increasing material consistency.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6148

Polyethylene Furanoate (PEF) Market Segmentation Insights

Grade Insights

How Did the Standard Grade Segment Dominate the Polyethylene Furanoate (PEF) Market?

Standard grade dominates due to it being the easiest grade to commercialize. Early users needed a material that could replace traditional plastics without changing machinery. Standard grade offered acceptable strength, barrier properties, and process stability at a reasonable cost. It allowed manufacturers to test PEF in real production environments without high risk.

The high-performance segment is anticipated to grow fastest during the projected period, owing to industries now demanding more than basic plastic replacement. Companies want stronger, lighter, and longer- lasting materials. High-performance PEF offers better gas barrier, heat resistance, and mechanical strength. As packaging moves toward thinner and lighter designs, stronger materíais become essential.

Application Insights

Which Application Segment Dominates the Polyethylene Furanoate (PEF) Market?

The bottles segment dominated the market, due to it provided the fastest path to market for polyethylene furanoate. Beverage bottles require strong gas barrier properties, and PEF performs very well in this area. Companies could directly compare PEF bottles with existing plastic bottles. Bottles also offer high visibility, helping brands show sustainability efforts to consumers.

The films and sheets segment offers significant growth during the forecast period, akin to flexible packaging is growing faster than rigid packaging. These applications need excellent barrier performance with very thin material layers. PEF allows strong protection even at low thickness. Food packaging, industrial wraps, and protective layers will increasingly demand sustainable materials. Films also reduce transportation weight and storage space.

End Use Insights

How did the Packaging Segment Dominate the Polyethylene Furanoate (PEF) Market?

The packaging segment dominates the market, mainly due to it facing the strongest pressure to reduce plastic waste. Governments, retailers, and consumers pushed packaging companies to adopt sustainable materials quickly. PEF offered a solution that maintained product protection while improving environmental image.

The fiber & textile segment is an emerging segment projected to grow at a CAGR between 2026 and 2035, akin to the fashion industry is shifting toward sustainable materials. Brands want bio-based fibers that reduce environmental impact without sacrificing durability. PEF fibers offer strength, flexibility, and moisture resistance. Textile products also have longer life cycles, making material performance critical.

Source Insights

Why did the Plant-Based Segment Hold the Biggest Share in the Polyethylene Furanoate (PEF) Market?

Plant based segment dominates the market, owing to it offered a clear sustainability story. Companies could easily communicate that the material came from renewable plant sources. This helped brands meet environmental commitments and attract eco- conscious consumers. Plant-based sourcing also reduced dependence on fossil fuels. Early adopters preferred materials with simple and transparent origins.

The biobased segment is experiencing the fastest growth in the market during the projected period, as sustainability expectations are becoming stricter. Future regulations will focus not only on plant origin but also on total environmental impact. Bio-based processes will emphasize lower emissions, higher efficiency, and circular material use. Advanced bio technologies will improve consistency and scalability.

Regional Insights

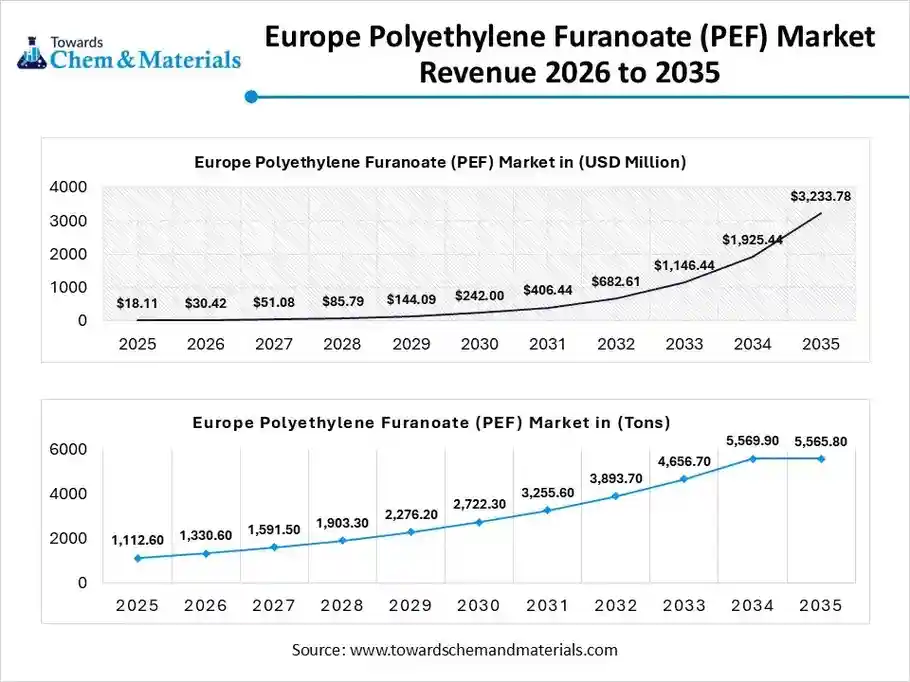

Europe Polyethylene Furanoate (PEF) Market Analysis

The Europe polyethylene furanoate (PEF) market size was valued at USD 18.11 billion in 2025 and is expected to be worth around USD 3,233.78 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 67.95% over the forecast period from 2026 to 2035. The Europe polyethylene furanoate (PEF) market volume was estimated at 1,112.6 tons in 2025 and is projected to reach 5,565.8 tons by 2035, growing at a CAGR of 19.59% from 2026 to 2035. Europe dominated the market with the 48.80% share in 2025.

The Europe region leads the global market because it has the highest implementation of the sustainability standards among all regions nowadays. Moreover, the major manufacturers in Europe have been seen in replacing the traditional plastics with the biobased alternatives, which has increased the commercial viability of the industry in recent years.

The UK Polyethylene Furanoate (PEF) Market Trends

The UK market is at an early but growing stage, driven by rising demand for sustainable and bio-based alternatives to conventional plastics. Strong regulatory pressure on carbon reduction and plastic waste is encouraging interest in PEF for packaging, especially in food, beverage, and consumer goods applications. Brands are attracted to PEF's superior barrier properties and recyclability, which align well with the UK's circular economy goals.

Why is the Polyethylene Furanoate (PEF) Market Growing Rapidly in the Asia Pacific?

The Asia Pacific region is the fastest-growing region, akin to strong government support for bio-based manufacturing. Many countries in this region are reducing dependence on fossil-based plastics to manage waste and pollution. PEF fits well because it is made from renewable sources and supports long-term environmental goals.

China Polyethylene Furanoate (PEF) Market Trends

China's market is emerging as part of the country's broader push towards bio-based and low-carbon materials. Government policies supporting green manufacturing and carbon neutrality goals are stimulating research, pilot projects, and early commercialization of PEF.

What is Going Around the Global Polyethylene Furanoate (PEF) Industry

In January 2025, Avantium shared a notification on the FDCA flagship plant startup, which is located in the Netherlands. Also, the company is expected to have a fully working plant in mid-2026 as per the published report.

More Insights in Towards Chemical and Materials:

Stainless Steel-Filled Polymer Filaments Market Size to Hit USD 157.82 Mn by 2035

Polyisobutylene Market Size to Reach USD 5.18 Billion by 2035

Biaxially Oriented Polypropylene (BOPP) Market Size to Hit USD 224.40 Billion by 2035

Bio-polyols Market Size to Hit USD 21.47 Bn by 2035

Asia Pacific Polymer Foam Market Size to Hit USD 131.7 Bn by 2035

Polyhydroxyalkanoate (PHA) Market Size to Hit USD 586.98 Mn by 2035

Organosilicon Polymers Market Size to Hit USD 29.88 Bn by 2035

Polymeric Methylene Diphenyl Diisocyanate Market Size to Hit USD 28.49 Bn by 2035

Polymer Nanocomposites Market Size to Hit USD 60.89 Bn by 2035

Conductive Polymers Market Size to Surpass USD 14.81 Bn by 2035

Polybutene-1 Market Size to Hit USD 1,061.10 Million by 2035

Unsaturated Polyester Resin Market Size to Hit USD 33.40 Bn by 2035

Polyester Fiber Market Size to Hit USD 274.58 Billion by 2035

U.S. Recycled Polyolefins Market Size to Surpass USD 21.68 Bn by 2035

Polyphenylene Sulfide Market Size to Hit USD 4.89 Billion by 2035

Ion-Conductive Polymers Market Size to Hit USD 8.75 Bn by 2035

Europe Biopolymers Market Size to Surge USD 18.23 Billion by 2035

U.S. Biopolymers Market Size to Worth Around USD 22.16 Bn by 2035

Thermoplastic Polyimides Market Size to Hit USD 1,926.61 Mn by 2035

Polyphthalamide Market Size to Reach USD 7.82 Bn by 2035

Top Companies in the Polyethylene Furanoate (PEF) Market & Their Offerings:

Tier 1:

- AVA Biochem AG: Produces high-purity 5-HMF, a vital bio-derived precursor and building block for PEF manufacturing.

- Origin Materials: Operates a platform to produce plant-based FDCA, the essential chemical monomer for carbon-negative PEF.

- TOYOBO CO., LTD.: Specializes in the polymerization and production of high-performance PEF films with superior barrier properties.

- BASF SE: Historically focused on industrial-scale FDCA production to support global PEF manufacturing through strategic partnerships.

- Mitsui & Co., Ltd.: Acts as a global distributor and marketer for 100% bio-based PEF resins and flexible packaging films.

- Corbion: Develops proprietary biotechnological routes to produce FDCA from renewable sugars for PEF synthesis.

- Danone: Leads as a brand partner to implement 100% plant-based PEF bottles for sustainable beverage packaging.

- ALPLA Group: Provides expertise as a packaging manufacturer to develop and commercialize bio-based PEF bottles.

- Swicofil AG: Supplies high-performance PEF yarns and fibers as sustainable alternatives for the textile and industrial sectors.

- Zhejiang Sugar Energy Technology Co., Ltd.: Focuses on converting biomass into FDCA and furan derivatives to support the PEF supply chain.

Tier 2:

- Eastman Chemical Company

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Gevo, Inc.

- Stora Enso

- Sukano AG

- ADM (Archer Daniels Midland)

- WIFAG-Polytype Holding AG

Polyethylene Furanoate (PEF) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Polyethylene Furanoate (PEF) Market

By Source

- Plant-based

- Bio-based

By Grade

- Standard Grade

- High-Performance Grade

- Blended/Customized Grade

By Application Area

- Bottles (Beverages, Personal Care)

- Films & Sheets (Food Packaging, Industrial)

- Fibers (Textiles, Industrial Apparel)

- Molded Components (Automotive, Electronics)

- Extruded Components

By End-Use Industry

- Food & Beverage Packaging

- Fiber & Textiles

- Automotive & Transportation

- Electrical & Electronics

- Pharmaceuticals & Medical

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6148

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.